Basic PolicyAbout Us

MEL mainly invests in logistics facilities for the ultimate purpose of maximizing unitholder value through management utilizing the comprehensive strengths of the MEC Group (Note 1) and also in order to contribute to the realization of an affluent society through development of logistics functions that support the lives of people.

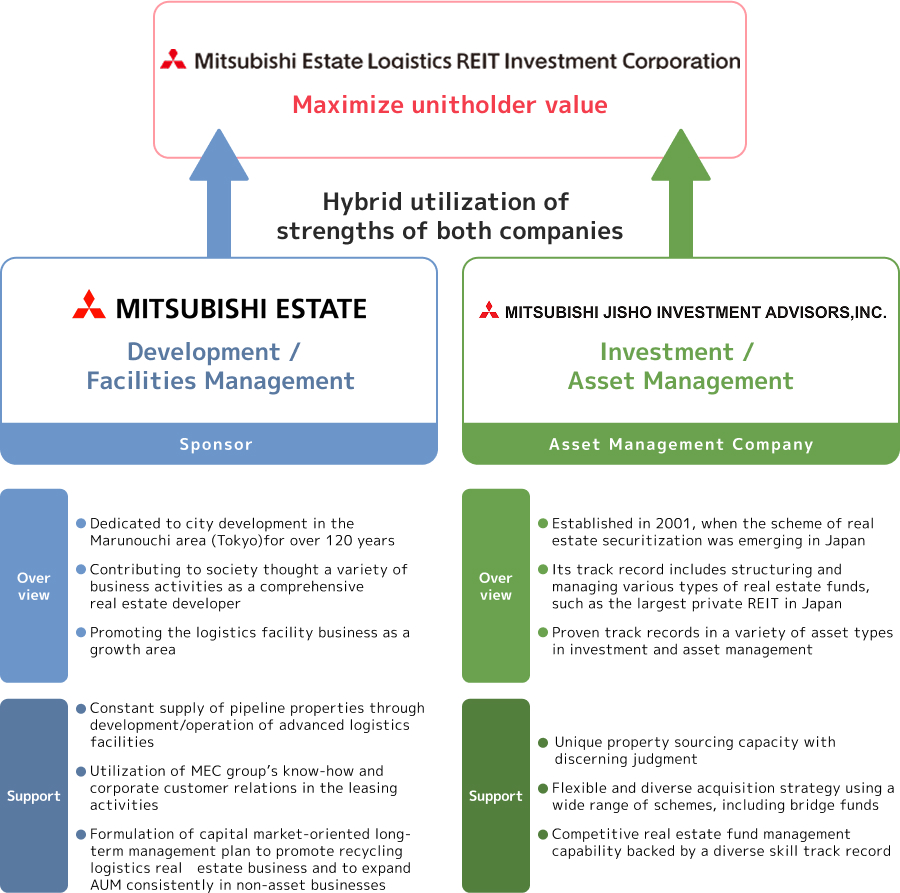

Mitsubishi Estate Co., Ltd. (MEC) is one of the largest comprehensive developers in Japan, and Mitsubishi Jisho Investment Advisors, Inc. (MJIA) is a real estate asset management company boasting an extensive track record in real estate fund management since its establishment in 2001. Through “HYBRID” (Note 2) utilization of the strengths of both companies, MEL aims for maximization of unitholder value by striving for the building of a high-quality portfolio and steady and stable asset management as a listed real estate investment corporation investing mainly in logistics facilities.

Utilizing the comprehensive strengths of the MEC Group based on trust earned through “urban development” of the Tokyo Marunouchi and other areas, MEL plays a part in the logistics platform (Note 3) in Japan and also contributes to the development of logistics functions that support the livelihood of people by adapting to changes in the environment surrounding the logistics facilities business.

| (Note 1) | “MEC Group” refers to the corporate group comprising Mitsubishi Estate Co., Ltd. and its consolidated subsidiaries. |

|---|---|

| (Note 2) | “HYBRID,” as in the English term “hybrid” meaning a combination of two things, is used in the context of utilization of the strengths of MEC and MJIA to refer to the strengths of both companies being utilized creatively and at times combined depending on the situation and thereby making the most of these in the management of MEL. |

| (Note 3) | “Logistics platform” is used to mean the business base for logistics. |