Management StructureFeatures and Strategies

- Home

- Features and Strategies

- Management Structure

MEL constructs an management structure with emphasis on enhancement of unitholder value.

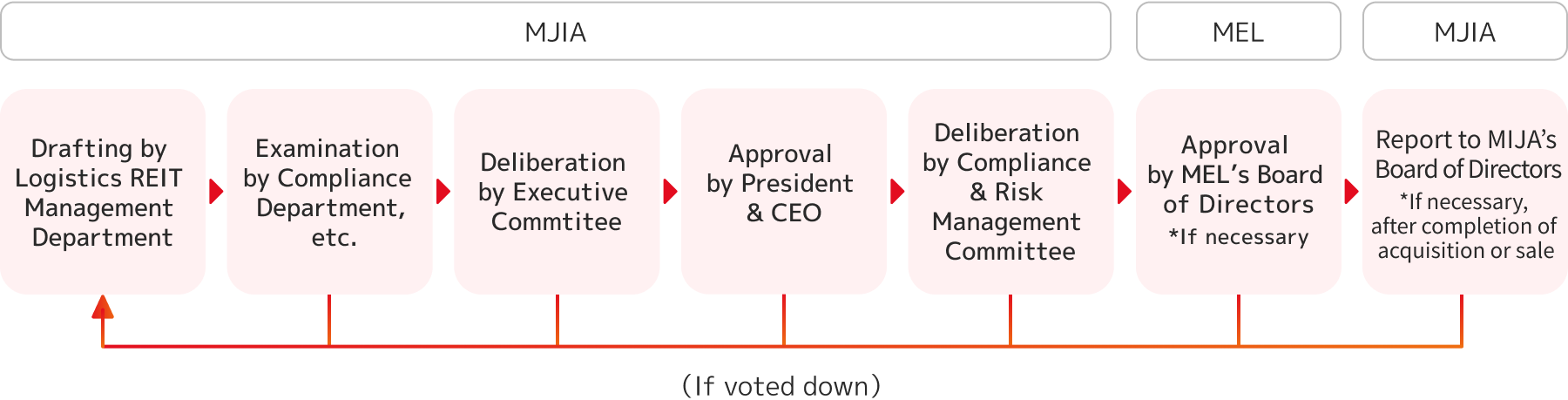

Decision-Making Flow in the Case of Asset Acquisition or Sale Falling Under Related-Party Transactions

Acquisition or sale of assets at MEL undergoes a transparent decision-making process.

| (Note) | An example of the decision-making flow in cases that fall under the category of transactions with interested persons, etc. requiring approval of the board of directors of the investment corporation pursuant to Article 201-2 of the Act on Investment Trusts and Investment Corporations. |

|---|

Rules concerning the preferential negotiation right on acquisition

In addition to MEL, MJIA manages a private REIT and private funds, investing in offices, residentials, commercial facilities, hotels, etc. MEL has the preferential negotiation right on acquisition of its target logistics properties and industrial properties.

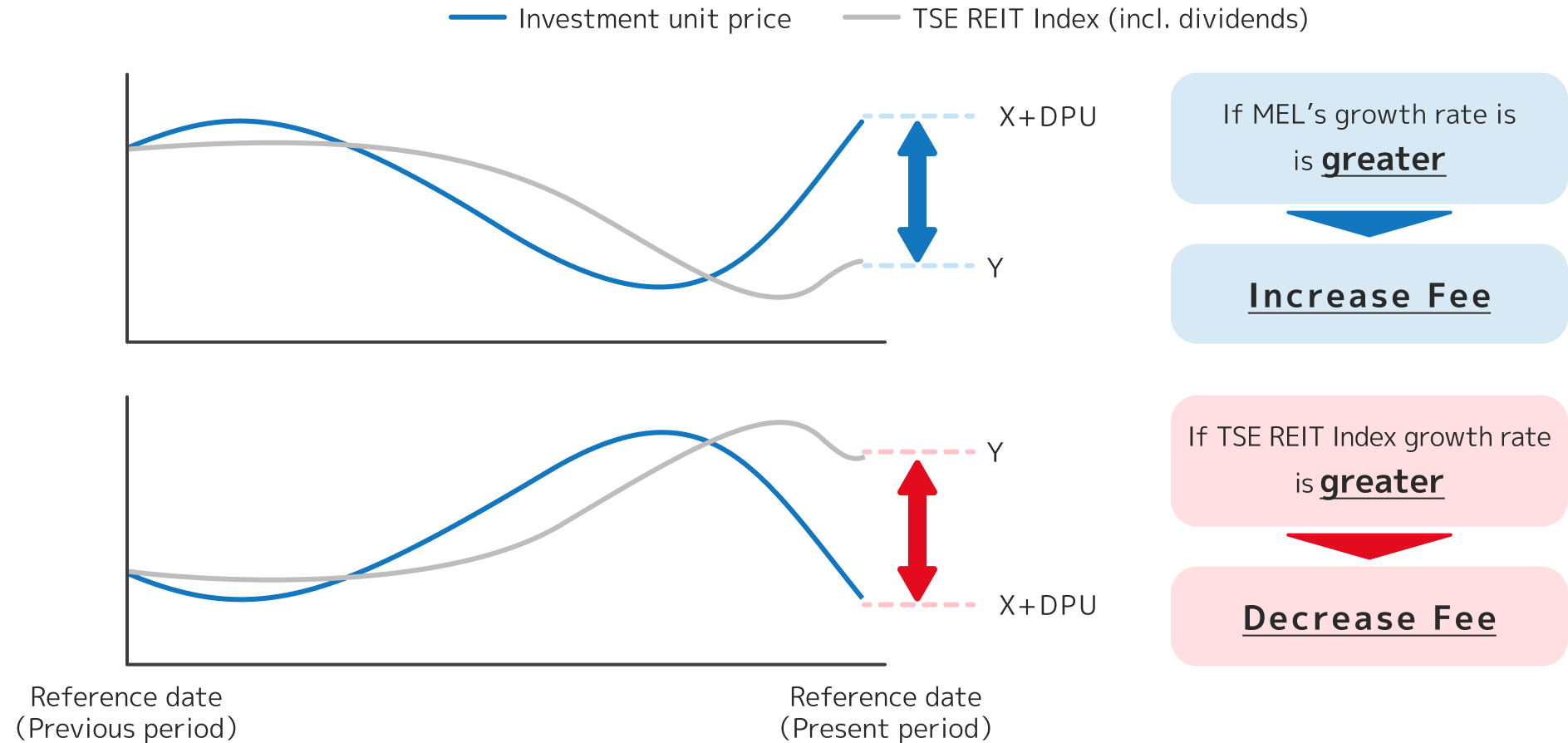

Asset management fee structure aligned with the unitholders' interests

To strengthen the alignment between Asset Management Company and unitholder interest, MEL introduced an asset management fee reflecting the relative performance between MEL's investment unit price and the TSE REIT Index.

| Asset management fee Ⅰ (AUM-linked) |

Total assets as of the end of previous period x 0.2% (upper limit) |

|---|---|

| Asset management fee Ⅱ (Real estate profit-linked) |

Adjusted NOI × 5.0% (upper limit) |

| Asset management fee Ⅲ (Unitholder interest-linked) |

Adjusted net income before tax × net income before tax per unit × 0.001% (upper limit) |

| Performance against TSE REIT Index ((a) – (b)) × market capitalization (for fiscal period of each term) × 0.1% (upper limit) (a):Fluctuations in MEL's investment unit price (incl. dividends) (b):Fluctuations in the TSE REIT Index (incl. dividends) |

|

| Acquisition fee | Acquisition price × 1.0% (upper limit) |

| Disposition fee | Disposition price × 0.5% (upper limit) |

| Merger fee | Appraisal value of assets to be succeeded × 1.0% (upper limit) |

Asset management fee fully linked to unit price performance

Same-boat investment by Mitsubishi Estate

Mitsubishi Estate, our sponsor holds our investment units with the aim of aligning the interests between unitholders and the sponsor.

Numbers of units and ratio held by the sponsor.