External Growth Strategy / Internal Growth StrategyFeatures and Strategies

- Home

- Features and Strategies

- External Growth Strategy / Internal Growth Strategy

External Growth Strategy

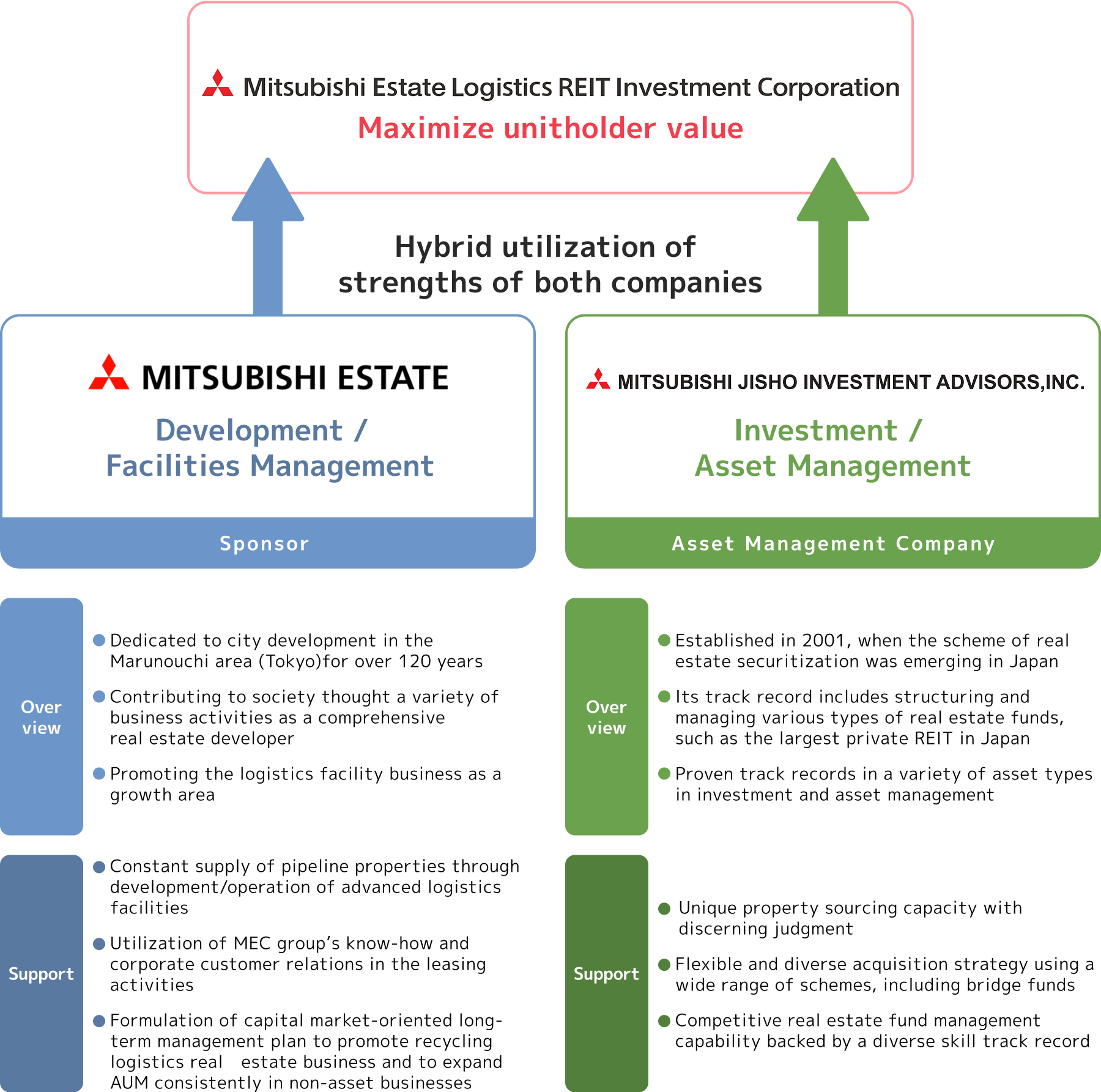

Hybrid External Growth Strategy

We aim to achieve steady external growth by utilizing two channels: the state-of-the-art “Logicross” series developed by Mitsubishi Estate, and the “MJ Logipark” series, in which the know-how of the asset management company is utilized.

Features of Mitsubishi Estate’s logistics business (Logicross)

Mitsubishi Estate Group carries out an integrated process from development by Mitsubishi Estate, a comprehensive developer, to the operation and management by its subsidiary Tokyo Ryutsu Center (TRC), which has been engaged in the logistics facility business since 1967.

Logicross Nagoya Kasadera

Logicross Fukuoka Hisayama

Conduct development by leveraging the strengths of a comprehensive developer with extensive development experience, including advanced development capabilities, coordination with government and other relevant parties, and land consolidation.

Developing advanced initiatives such as the development of logistics facilities directly connected to expressway interchanges that are compatible with automated trucks.

Utilizing experience in overseas development of office buildings and other facilities, also expanding logistics facilities business overseas, particularly in Asia and the United States.

Logicross Hasuda

(Tentative name) Kyoto Joyo core logistics facility (rendering)

Features of external growth strategy through unique initiatives by MJIA

Leveraging the know-how and relationships of MJIA, we source through unique routes such as the Partnership Development Program (PDP) and Corporate Real Estate (CRE) schemes. Additionally, we implement flexible acquisition strategies, including adjusting acquisition timing and prices with reduction in book value through bridge schemes.

PDP(Partnership Development Program)

By collaborating with partners to develop logistics facilities, MEL will obtain preferential negotiation right to acquire these properties upon completion and lease-up. MJIA contributes to various processes from sourcing to exit strategies, depending on the project.

Functions offered by MJIA

MJ Logipark Ichinomiya 1

MJ Logipark Takatsuki 1

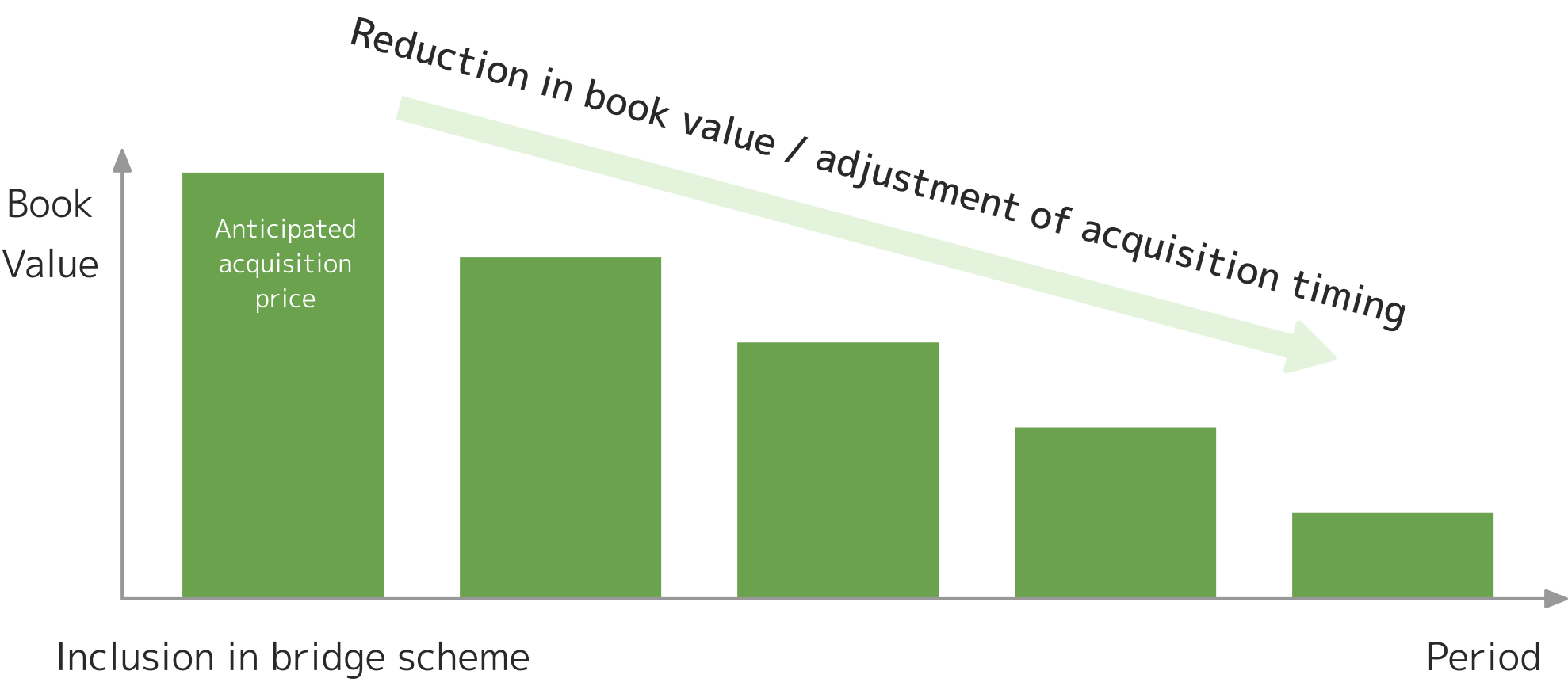

Bridge Scheme

Utilizing the private fund management know-how of MJIA, we comprehensively consider acquisition timing, costs, project scale, and information routes to select the optimal bridge method. MEL can acquire the property when the conditions for acquisition are met. It is also possible to adjust the acquisition price through the book value reduction effect of the bridge.

Image of reduction in book value through a bridge scheme

Internal Growth Strategy

Hybrid Internal Growth Strategy

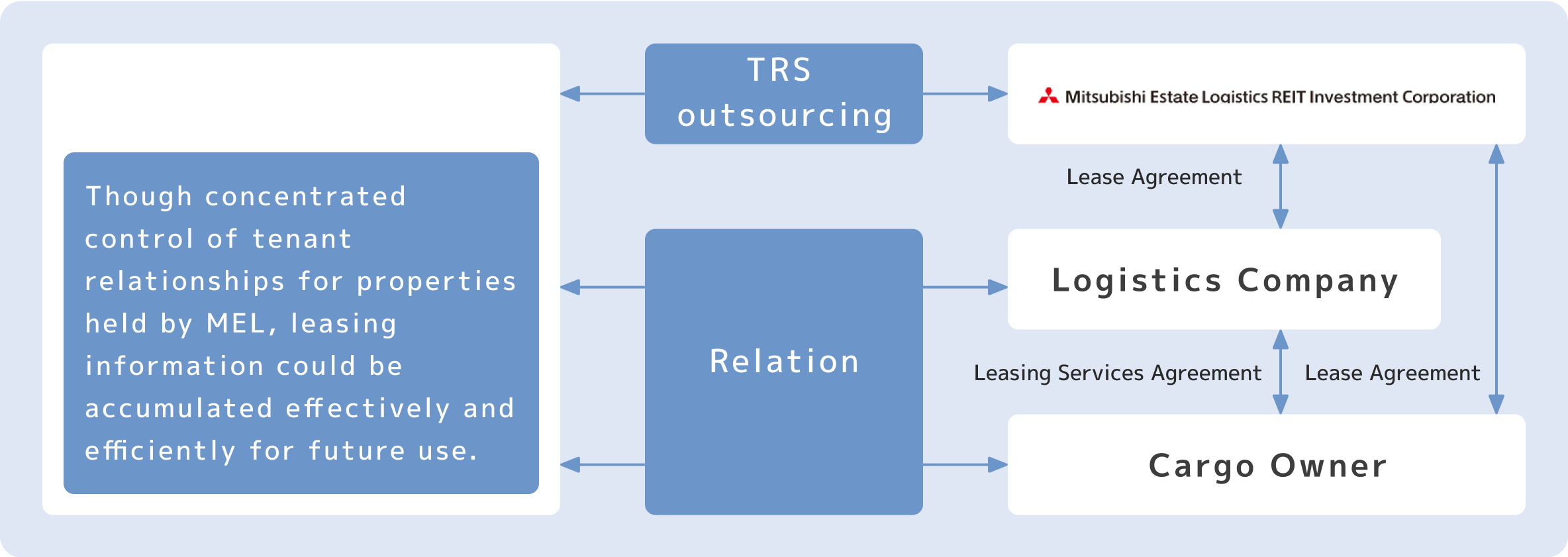

We aim for steady internal growth through unique initiatives beyond rent increase, leveraging the operational know-how and customer network of the Mitsubishi Estate Group for tenant relationship support (TRS) and the operational capabilities based on the extensive track record of real estate funds.

Internal Growth Strategy by our Sponsor

Tenant Relationship Support (TRS)

We aim to achieve mid-to long-term internal growth by outsourcing tenant relationship management, leasing activities, and rental policy proposals to our sponsor.

Example of Tenant Leasing by Mitsubishi Estate

Logicross Fukuoka Hisayama

Successfully captured the logistics facility needs of existing tenants in office buildings operated by the Mitsubishi Estate Group.

Collaboration with Tokyo Ryutsu Center (TRC)

| ● | Mitsubishi Estate made Tokyo Ryutsu Center (TRC) a consolidated subsidiary in 2016. TRC has extensive experience in operating logistics facilities. |

|---|---|

| ● | Mainly collaborate in operation and management |

Realize Internal Growth by MJIA’s Unique Initiatives other than rent revision

MEL realize internal growth by leveraging MJIA’s proprietary know-how based on extensive experience of real estate fund management capabilities.

Funds and Products managed by Asset Management Company

Revenue Enhancement Measures (Example)

LED Installation Based on Green Lease Agreement

MJ Logipark Fukuoka 1 and Others

| ● | MEL bears the cost of installation of LED. A portion of the cost savings from the LED is collected from tenants as a green lease fee. |

|---|---|

| ● | This contributes to significant reductions in electricity costs and improves tenant convenience and satisfaction through the latest dimming functions. |

Cost Reduction Measures (Example)

Review of Property Tax

Logicross Atsugi and Others

| ● | We conducted a review of property tax for the properties. For properties where discrepancies in valuation were identified, we negotiated with the authorities to achieve a reduction. |

|---|

Introduction of Solar Power Generation Equipment

| ● | In collaboration with operators, solar power generation equipment has been introduced to the properties. |

|---|---|

| ● | By self-consuming the electricity generated by solar power, we reduce utility costs. |