External Growth Strategy

- Home

- Features and Strategies

- External Growth Strategy

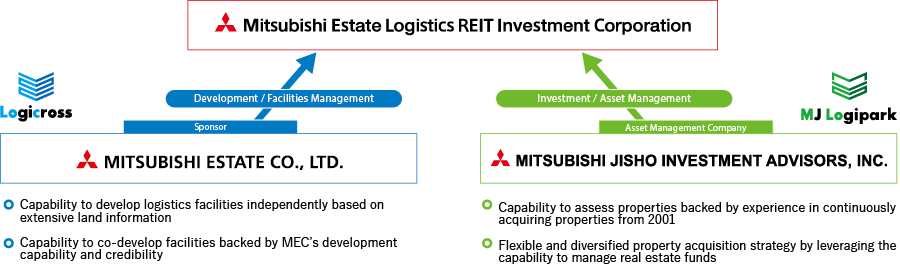

MEL aims for “HYBRID” external growth utilizing MEC’s development capability and MJIA’s capability to assess investment projects (acquisition capability).

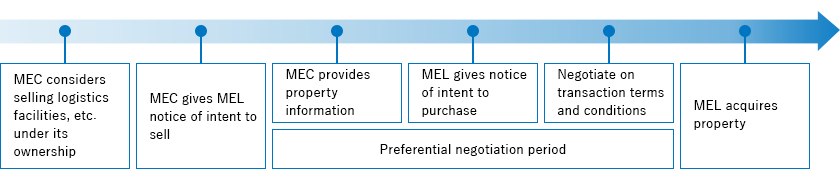

Preferential negotiation right based on sponsor support agreement with MEC

Based on the sponsor support agreement concluded with Mitsubishi Estate Co., Ltd. (MEC), in the event that MEC is to sell logistics facilities, etc. under its ownership, including its development projects, MEL shall have the right to be the first to negotiate for acquisition (Note).

| (Note) | There may be cases where MEL is not granted the preferential negotiation right based on the sponsor support agreement, such as cases where consent for the grant of the preferential negotiation right or the sale has not been obtained from co-owners, quasi-co-owners or joint business partners, if there are any such parties. |

|---|

Flow of Preferential Negotiation

External growth relying on MJIA’s selection capability and fund scheme

Mitsubishi Jisho Investment Advisors, Inc. (MJIA) has a proven track record in continually arranging funds and acquiring properties since 2001. MJIA applies its capability to assess investment projects (acquisition capability) and due diligence capability based on such track record to make selective investment in highly competitive logistics facilities that capture tenant needs. In addition, MJIA applies its capability to manage real estate funds to promote flexible acquisition strategies based on the development fund structure (Note 1), the bridge structure (Note 2) and other diversified acquisition methods.

| (Note 1) | "The development fund structure" refers to the method of acquiring properties from development funds for which MJIA is entrusted to provide investment advisory services. |

|---|---|

| (Note 2) | "The bridge structure" refers to the method of acquiring properties with agility by utilizing bridge funds depending on the capital market environment and property acquisition timing. |

Properties with Preferential Negotiation Right Granted by Bridge Funds

Bridge funds have been arranged to hold and manage real estate, etc. assumed to be acquired by MEL. As of September 14, 2017, the bridge funds are in agreement with silent partners to the effect that, in the event that logistics facilities, etc. held by the bridge funds are to be sold, the bridge funds shall first negotiate with MEL.

MEC Group’s Logistics Facilities Brands

Under the MEC Group’s brand slogan “A Love for People, A Love for the City,” the MEC Group operates two brands of logistics facilities—the “Logicross” brand of logistics facilities that are independently developed by MEC and the “MJ Logipark” brand of logistics facilities that are acquired by MJIA from third parties. The two brands both adopt the policy to provide logistics facilities, centering on “safety and security,” that contribute to the realization of an affluent society through increasingly active movement of people and goods and also business.

Under the MEC Group’s brand slogan “A Love for People, A Love for the City,” the MEC Group operates two brands of logistics facilities—the “Logicross” brand of logistics facilities that are independently developed by MEC and the “MJ Logipark” brand of logistics facilities that are acquired by MJIA from third parties. The two brands both adopt the policy to provide logistics facilities, centering on “safety and security,” that contribute to the realization of an affluent society through increasingly active movement of people and goods and also business.