Internal Growth Strategy

- Home

- Features and Strategies

- Internal Growth Strategy

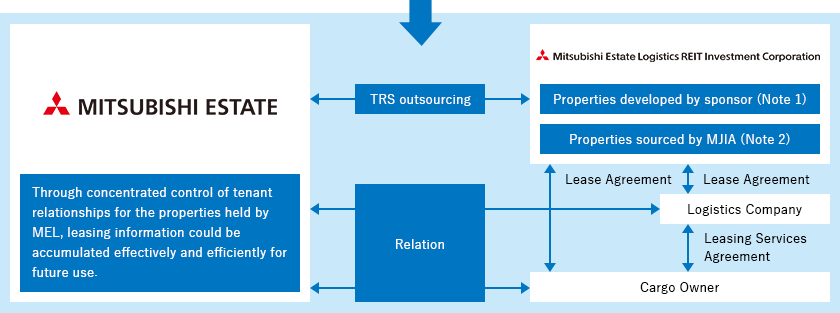

MEL aims for “HYBRID” internal growth utilizing MEC’s corporate customer relations and MJIA’s capability to manage real estate funds.

Leasing Support Utilizing MEC’s Corporate Customer Relations

Utilizing the corporate customer relations that Mitsubishi Estate Co., Ltd. (MEC) has built on the office and retail property businesses, etc., centering on the Tokyo Marunouchi area, through outsourcing of tenant relations support (TRS) services to MEC, MEL aims to realize steady internal growth capturing market needs by building relationships with logistics operators and cargo owners. By outsourcing TRS services to the sponsor and thereby maximizing the sponsor’s commitment to leasing, MEL aims to realize maintaining and enhancing portfolio revenue over the medium-to-long-term.

TRS Services

- ❶ Tenant relation

- Periodically visit tenants and build a relationship with them to extend leasing period, understand their needs for floor increase and relocation, matching vacant lots, preventing leaving, etc.

- ❷ Tenant recruitment

- In addition to soliciting tenant candidates, supporting tenant screening and mediating and negotiating moving in conditions, construction works, etc.

- ❸ Proposal of leasing policy

- Manage leasing periods on all owned assets and offer the strategy to replace tenants

| (Note 1) | “Properties developed by sponsor” refers to logistics facilities, etc. under development or developed independently or jointly by MEC. |

|---|---|

| (Note 2) | “Properties sourced by MJIA” refers to logistics facilities, etc. for which Mitsubishi Jisho Investment Advisors, Inc. (MJIA) own sourced property information that led to property acquisition by MEL. |

Track Record of Stable Management of Properties of Diverse Asset Types

Track record of MJIA (As of March 31, 2024)

- AUM (Note)

- 1,233.4billion yen

| (Note) | “AUM” includes cases where MJIA is entrusted to provide investment management services or investment advisory services. |

|---|

Stable management of logistics facilities

With “MJ Logipark Funabashi 1” that was acquired via a bridge fund in March 2013 as a start, logistics facilities have been managed in funds arranged by MJIA.

Even with the increasing amount of AUM of the funds for logistics facilities, etc. for which MJIA is entrusted to provide investment management services or investment advisory services, MJIA is maintaining the occupancy rate of the assets under its management at a high level.