Environmental Initiatives (E) Climate Change Initiatives

Awareness of Climate Change

The Paris Agreement, adopted in 2015, is an international treaty that aims to pursue efforts to limit temperature rise 1.5℃ and to keep it well below 2℃ above pre-industrial levels. Many countries, regions, and industries are already taking steps to reduce greenhouse gas (hereinafter referred to as"GHG") emissions by 2050, and are continuously discussing the way of strengthening GHG emission regulations to achieve this goal.

According to IPCC Report (Note), there is no doubt that human activities have caused global warming mainly through GHG emissions, which have already led to an increase in natural disasters such as frequent heat waves and extremely heavy rainfall around the world.

MEL recognizes that climate change is an issue that will have a significant impact on maximizing unitholder value over the medium to long term and has positioned it as one of its materialities, aiming to achieve net zero total GHG emissions throughout the value chain by 2050.

(Note)Report published in 2018 by the United Nations Intergovernmental Panel on Climate Change (IPCC)

Supporting for TCFD Recommendations

TCFD (Task Force on Climate-Related Financial Disclosures) was established by the Financial Stability Board (FSB) to consider how to disclose climate-related information and respond to financial institutions. The TCFD recommends that companies disclose their climate change governance, strategy, risks and opportunities, and indicators and targets.

In December 2021, MJIA announced its support for the TCFD recommendations and joined the TCFD Consortium, an organization of domestic companies that support TCFD recommendation.

MEL identifies risks and opportunities related to climate change and their impact on MEL's business, and promotes responses to and disclosure of such risks and opportunities.

(Disclosure Items Recommended by TCFD)

This table can be scrolled sideways.

| Disclosure Item | Disclosure Details |

|---|---|

| Governance | Organizational governance relating to climate-related risks and opportunities |

| Strategy | Actual and potential impacts from climate-related risks and opportunities on the organization's businesses, strategies, and financial planning |

| Risk management | The organization's climate-related risk identification, assessment, and management processes |

| Metrics and Targets | Metrics and targets used to assess and manage climate-related risks and opportunities |

Governance

MJIA's Sustainability Committee discusses and decides on climate-related strategies, identification of risks and opportunities, setting of indicators and targets, and measures to them, and reports to the Board of Directors.

Please refer to the ”Organization Chart for Promoting Sustainability” page for the system for promoting sustainability (including responses to climate change; the same hereafter) at MJIA.

Strategy

1.Scenario analysis

MEL conducted multiple scenario analyses to identify the risks and opportunities posed by climate change risks to MEL and to examine their impact on its business.

<Assumptions for Scenario Analysis>

MEL conducted scenario analysis using future climate projections published by international organizations as the main source of information. The table below shows the main sources of information referred to by MEL. Climate change risks can also be broadly categorized into "transition risk" and "physical risk," and the relationship between them is considered not to be completely independent but interdependent or trade-off.

This table can be scrolled sideways.

| Climate Change Risks | Main Information Sources Referenced | |||||

|---|---|---|---|---|---|---|

| Transition risk | Risks arising from new regulations, tax systems, technologies, etc. to realize a decarbonized society |

IEA (International Energy Agency) World Energy Outlook 2022

|

||||

| Physical risk | Risks rising by climate change itself, such as changes in weather |

IPCC (Intergovernmental Panel on Climate Change) Sixth Assessment Report (AR6)

|

||||

【4℃ Scenario】

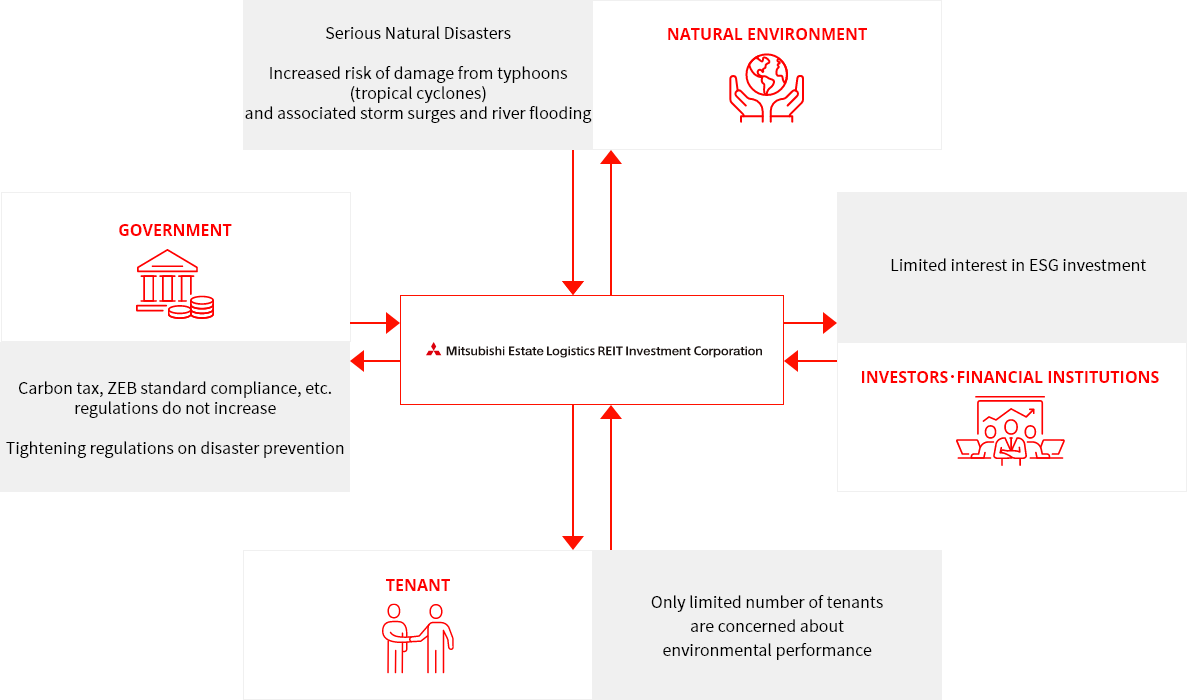

The 4℃ Scenario assumes that natural disasters will become severe and physical risks will be extremely high due to the lack of progress in global decarbonization efforts, although the risk of transition will be relatively small due to the lack of progress in strengthening legal regulations.

【1.5℃ Scenario】

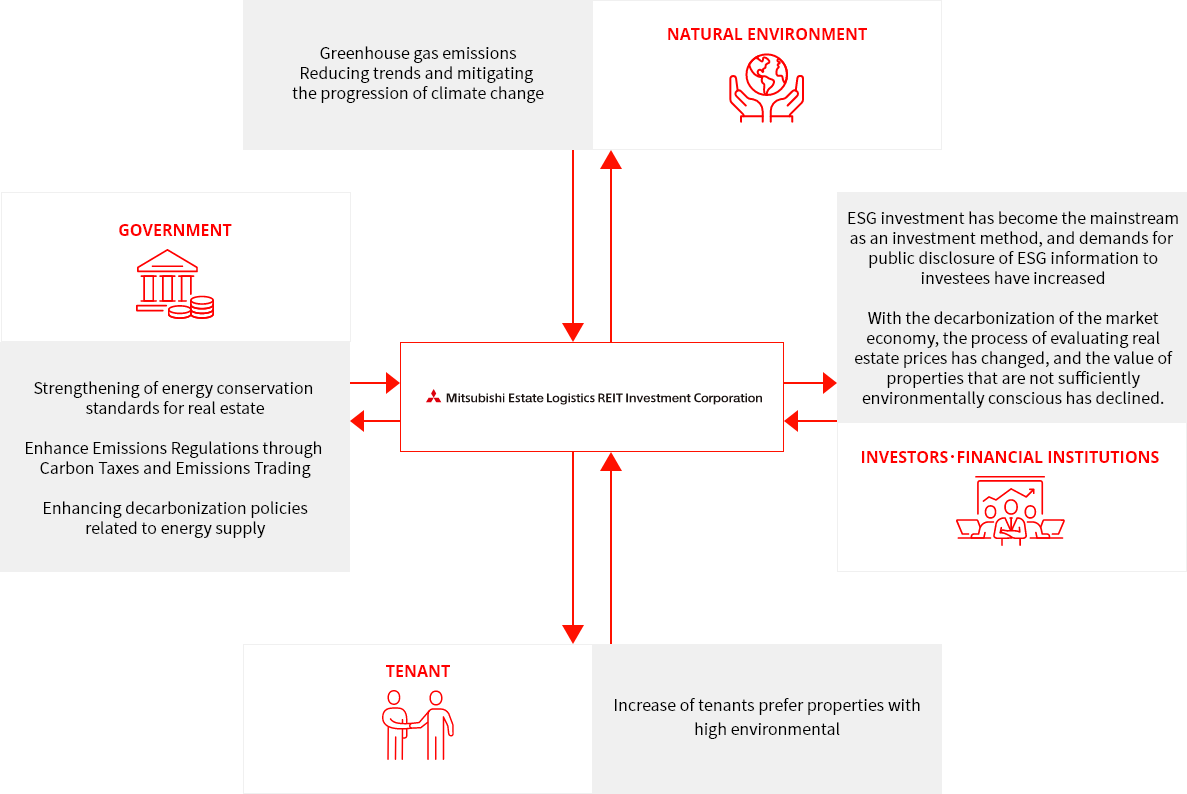

1.5℃ Scenario is based on the assumption that emissions of greenhouse gases will tend to be reduced by implementing strict regulations and taxation systems to realize a decarbonizing society. Physical risks are low, and transition risks are high.

2.Identification of Climate Change Risks and Opportunities and Verification of Financial Impacts

This table can be scrolled sideways.

| Category | Relations | Type | Financial impacts | Scope of Financial Impact Amount | |||||

|---|---|---|---|---|---|---|---|---|---|

| 1.5℃ | 4℃ | ||||||||

| Medium term | Long term | Medium term | Long term | ||||||

| Transition risk | Policies and Laws | Enhance Taxation through the Introduction of a Carbon Taxes | Risk | Increased tax burden on portfolio GHG emissions | Small | Small | Small | Small | |

| Enhance energy-saving standards in real estate | Risk | Increased burden of portfolio renovation costs | Small | Small | Small | Small | |||

| Technology | Evolution and dissemination of re-energy and energy-saving technologies | Risk | Acquisition of ZEB properties Increase in costs of installing energy-saving equipment and procuring renewable energy |

Small | Small | Small | Small | ||

| Cost reduction through energy conservation and renewable energy | Opportunity | Reduction of utility costs sourced externally | Small | Small | Small | Small | |||

| Markets | Deterioration of procurement conditions for market participants not responding to climate change | Risk | Increase in funding costs, difficulty in financing and decrease in investment unit price | Small | Small | Small | Small | ||

| Increasing demand of green buildings from tenants | Risk | Decrease in rent income due to difficulty in developing new tenants and reduced retention | Large | Large | Small | Small | |||

| Develop new tenants by expanding the provision of green building | Opportunity | Income increase and occupancy rate improvement by developing tenants | Large | Large | Small | Small | |||

| Develop and enlightenment of new investors | Opportunity | Utilization of green bonds. Increasing volume and lowering funding costs by responding to ESG-focused investors | Large | Large | Small | Small | |||

| Reputation | Devaluing a brand due to underdeveloped green building | Risk | Decrease in rent premiums due to brand strength Rising cost of funds |

Large | Large | Small | Small | ||

| Physical risk | Acute | Increased typhoons, torrential rains and floods | Risk | Increase in repair costs and insurance premiums Decline in portfolio occupancy |

Small | Small | Small | Small | |

| Building a portfolio with high resilience performance | Opportunity | Reduction of repair costs and insurance premiums Improve portfolio utilization rate |

Small | Small | Small | Small | |||

| Chronic | Inundation of properties with low altitude due to sea level rise | Risk | Decreased utilization of portfolios that requiring major renovations | Small | Small | Small | Large | ||

| Increased demand for air conditioning due to extreme weather conditions | Risk | New installation of air conditioning equipment and increase in operating time and repair costs | Small | Small | Small | Small | |||

(Note)Medium term: As of 2030, Long term: As of 2050.

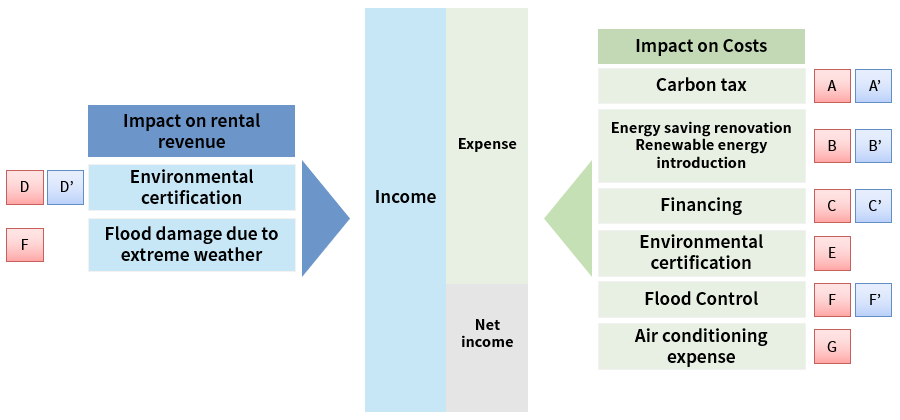

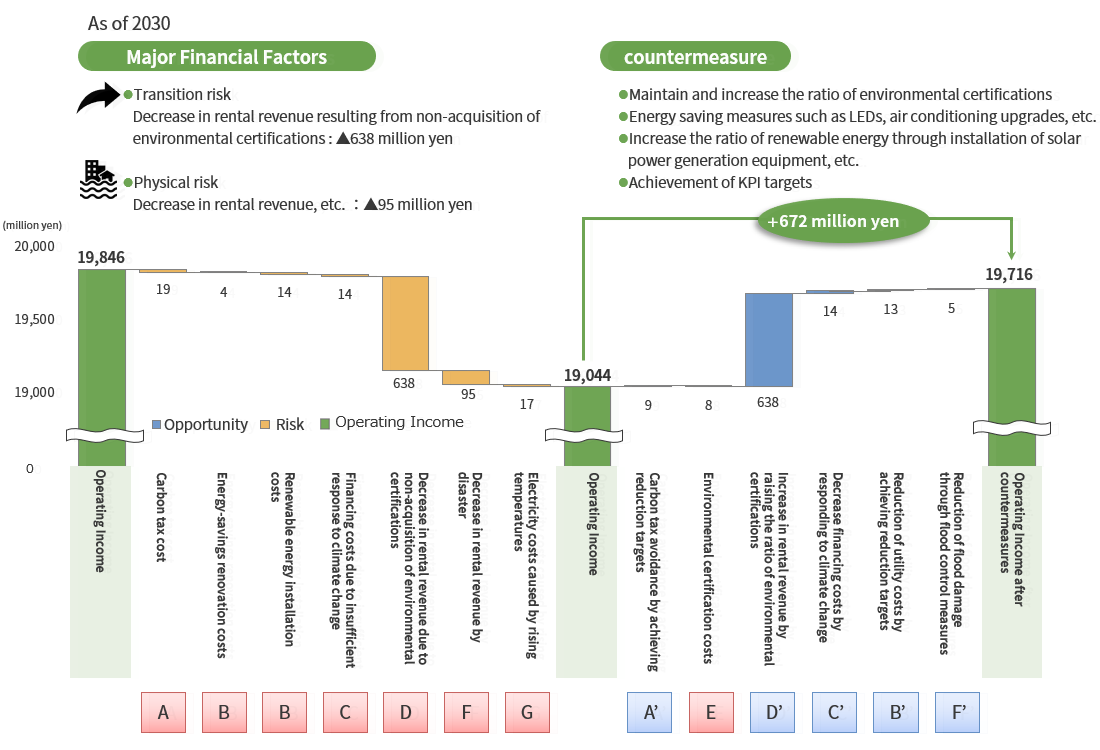

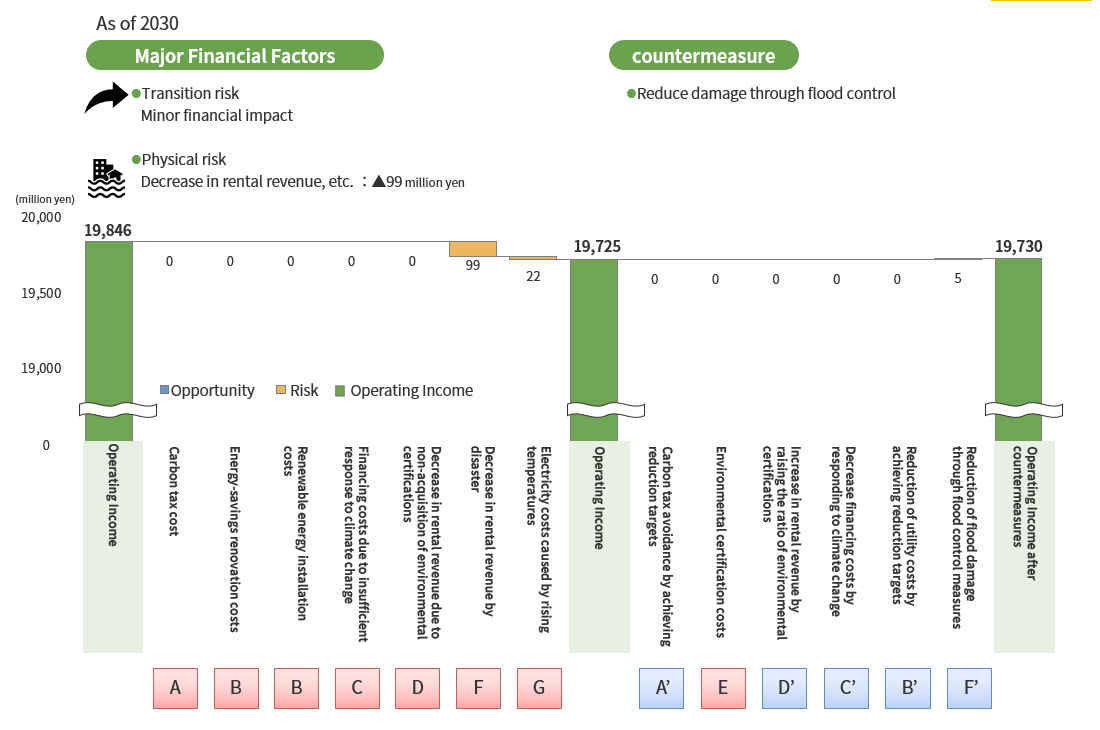

3.Quantitative analysis of financial impact

Organizing business impact on P/L

Financial impact quantitative analysis results of identified climate-related risks and opportunities

This table can be scrolled sideways.

| Category | Relations | Type | Financial impacts | Scope of Financial Impact Amount (million yen) |

|||||

|---|---|---|---|---|---|---|---|---|---|

| 1.5℃ | 4℃ | ||||||||

| Medium term |

Long term |

Medium term |

Long term |

||||||

| Transition risk | Policies and Laws | Enhance Taxation through the Introduction of a Carbon Taxes | Risk | Increase in carbon taxes | ▲19 | ▲48 | 0 | 0 | A |

| Opportunity | Avoidance of carbon tax through energy saving renovations and introduction of renewable energy | 9 | 44 | 0 | 0 | A’ |

|||

| Technology | Enhance energy saving standards in real estate and promote energy-saving and renewable energy technologies. | Risk | Increase in energy saving renovation costs | ▲4 | ▲37 | 0 | 0 | B |

|

| Risk | Increase in renewable energy installation costs | ▲14 | ▲22 | 0 | 0 | B |

|||

| Opportunity | Reduction of utility costs through energy-saving renovation and introduction of renewable energy | 13 | 31 | 0 | 0 | B’ |

|||

| Markets | Deterioration of procurement conditions for market participants not responding to climate change | Risk | Increase in financing costs due to inadequate response to climate change | ▲14 | ▲45 | 0 | 0 | C |

|

| Opportunity | Decrease in financing costs by addressing climate change | 14 | 45 | 0 | 0 | C’ |

|||

| Increasing demand of green buildings from tenants | Risk | Decrease in rental revenue resulting from nonacquisition of environmental certifications | ▲638 | ▲3,460 | 0 | 0 | D |

||

| Opportunity | Increase in rental revenue by increasing the ratio of environmentally certified properties in our portfolio | 638 | 3,460 | 0 | 0 | D’ |

|||

| Risk | Environmental certification costs | ▲8 | ▲14 | 0 | 0 | E |

|||

| Physical risk | Acute | Increase in typhoons, torrential rains and floods | Risk | Decrease in rental revenue and increase in repair costs caused by the disaster | ▲95 | ▲99 | ▲99 | ▲137 | F |

| Opportunity | Reduce damage through flood control | 5 | 5 | 5 | 7 | F’ |

|||

| Chronic | Increase in demand for air conditioning due to extreme weather conditions | Risk | Increase in electricity costs due to rising temperatures | ▲17 | ▲54 | ▲22 | ▲107 | G |

|

(Note) ①Medium-term: as of 2030, Long-term: as of 2050. ②Based on the starting point of the portfolio as of August 31, 2023.

■1.5°C scenario

Transition risks increase. Environmental certifications in the portfolio have a significant impact on the increase or decrease in rental revenue, but countermeasures are taken to limit the decline in operating income.

■4°C scenario

Physical risks increase. Operating income is expected to decrease slightly by building a highly resilient portfolio, despite a certain degree of damage to properties due to wind and flood damage and a decrease in rental revenues.

This estimation is based on an analysis of a portion of MEL's business scope and does not evaluate the overall impact. Based on policy trends in Japan and globally, MEL will continue to study the assumptions and expansion of the items covered by the estimation in order to further deepen the analysis.

*The accuracy of this estimate is not guaranteed. It is an annual impact estimated based on MEL's operational performance and other factors, and is based on scenarios presented by major institutions and various parameters in the literature. The countermeasures assumed are also assumptions based on trial calculations, and are not planned or determined to be implemented.

CRREM Analysis

CRREM (Carbon Risk Real Estate Monitor) calculates and publishes GHG emissions pathways (decarbonization pathways) to 2050 for each property use, consistent with the 2℃ and 1.5℃ targets of the Paris Agreement. MEL compares the CRREM 1.5℃ decarbonization pathway to the GHG emissions performance of the properties it owns, assesses the transition risk on a property-by-property basis, and uses this as a reference for measures to decarbonize its portfolio.

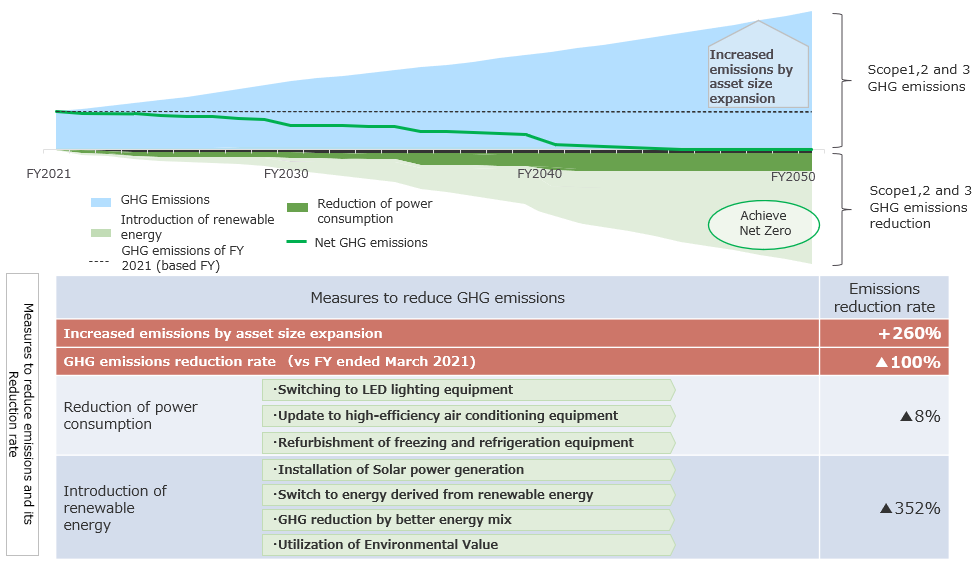

Roadmap for Reducing GHG Emissions

MEL has formulated Migration Roadmap for reducing GHG emissions and established new KPIs.

Going forward, MEL have set a goal of "achieving net zero GHG emissions for the entire value chain by FY2050," and will steadily implement each measure to achieve this goal.

Investment Corporation's Measures to Climate Change Risks

MEL is promoting a variety of measures and specific actions to address the "transition risks" and "physical risks" of climate change, including green projects to reduce GHG emissions and improve energy efficiency, and the acquisition of Environmental Certification.

Specific initiatives are as follows.

<Planned purchase of non-fossil certificates>

MEL has advocated the use of environmental value as part of reduction measures through the promotion of renewable energy, and since FY2021, MEL has been purchasing non-fossil certificates for a part of its portfolio in order to introduce renewable energy. We will systematically purchase non-fossil certificates and reduce GHG emissions.

<Contribution to the environment in the real estate under management>

https://mel-reit.co.jp/en/esg/environment/contributions.html

Risk Management

The risk management system for sustainability at MJIA is as follows.

At the time of investment decision: When making a new investment in assets under management, the management meeting makes an investment decision based on various surveys on climate change risk in the due diligence process. Specifically, regarding the possibility of flooding of the target property, we are investigating and confirming the inundation level, inundation history, and implementation history of hydraulic engineering work, etc. using various hazard maps. We also check the existence of environmental and energy-saving equipment, including the acquisition of environmental certification, and the status of BCP compliance.

During operation: The Sustainability Committee manages and monitors overall sustainability-related risks, including climate change risks. Specifically, we monitor the environmental performance of our properties and manage the progress of various targets (see "Indicators and Targets" below for details), and consider necessary measures based on these.

Metrics and Targets

MEL recognizes that resolving environmental issues such as climate change is an important management issue in MEL's sustainable business and its business strategy for realizing it. Based on this understanding, MEL is building a low-environmental impact portfolio by investing in low-environmental impact properties and making energy use more efficient and reducing GHG emissions through the implementation of environmental and energy-saving measures in owened properties.

Promotion of Green Property in possession

Target (KPI)

- Raise the ratio of property aquired Environmental Certification to 100% by 2030.

Improvement of environmental performance

Targets (KPIs)

- Reduce our portfolio GHG emissions (Scope 1, 2) by 42% by FY2030. (based on FY2021)SBTi

- Achieve net zero GHG emissions for the entire value chain by FY2050SBTi

- Reduce the energy consumption intensity by 15% by 2030. (based on FY 2017)