Governance Initiatives (G) Corporate Governance

Structure

MEL is composed of a board of directors consisting of one executive director and three supervisory directors and an independent auditor, in addition to the general meeting of unitholders composed of its unitholders. MEL is prohibited from employing employees in accordance with the Investment Trust Law. Therefore, there are no employees, and asset management is entrusted to MJIA. Under the following management structure, MJIA engages in asset management operations, such as the acquisition or transfer of real estate and the leasing of real estate.

Executive and Supervisory Directors

Composition: 4 (1 executive officer, 3 supervisors)

Female ratio: 25%

Attendance rate of the board meeting (11 times/11 times): 100%(Note 1)

※As of February 28, 2025(Note 1) Attendance at board of directors meetings held during the 16th fiscal period (ending August 2024) and 17th fiscal period (ending February 2025), in terms of number and percentage.

Status and remuneration of officers of the Investment Corporation

The remuneration for executive officers shall be up to 800,000 yen per month, and the remuneration for supervisory officers shall be up to 300,000 yen per month, the amount determined by the board of directors.

The standards for payment of remuneration for executive officers and supervisory officers are determined by the company's regulations.

This table can be scrolled sideways.

| Title and Name |

Qualifications | Executive remuneration (FY2024) (Note 1) | |||

|---|---|---|---|---|---|

| Executive Director Takuya Yokota (Male) |

- | - | |||

| Supervisory Director So Saito (Male) |

Lawyer | 2.4 million yen | |||

| Supervisory Director Akira Fukano (Male) |

Certified Public Accountant Tax Accountant |

2.4 million yen | |||

| Supervisory Director Naoko Yanaka (Female) |

Lawyer | 2.4 million yen |

(Note 1)Executive Director does not receive any remuneration from MEL. The amount of remuneration paid to supervisory directors is the amount paid for the most recent one-year period.

Accounting Auditor

In addition to auditing the financial statements of MEL, if the Accounting Auditor finds the conduct of business by theexecutive director(s) to be improper or discovers any material violation of law or the Articles, the Auditor shall report to a supervisory directors and take other actions set forth by law.

Accounting auditor

| Accounting auditor | Continuing accounting period |

|---|---|

| Ernst & Young ShinNihon LLC | From July 2016 until present |

Accounting Auditor's Remuneration

| FY2024 (thousands of yen) | |

|---|---|

| Compensation based on audit attestation services | 30,350 |

(Note) Remuneration for the accounting auditor includes fees for preparation of the comfort letter for the public offering and fees for the English language audit.

Management Structure

Management Structure with Emphasis on Maximizing Unitholder Value

MEL will seek to ensure to align interest between MEL's unitholders and Mitsubishi Estate Group, and maximize unitholder value as well as to establish and enhance a highly transparent management system.

In the event of transaction which falls under the category of transactions with interested parties, MJIA executes such transactions through a transparent decision-making process. In addition, transactions which exceeds a certain standard with interested parties must be deliberated and approved by the Compliance and Risk Management Committee. However, for transaction below a certain level, the approval of the General Manager of the Compliance Department is required. Through such deliberations, we will be able to carefully examine from many points of view and comprehensively judge whether or not to make a transaction. The Compliance and Risk Management Committee, which is composed of outside attorney, enhances the checks and balances against conflicts of interest transactions from the standpoint of experts. In deliberations on the acquisition and sale of properties by MEL, the Management Committee is composed of real estate appraisers who do not have a special interest in the Mitsubishi Estate Group, and is expected to participate in the deliberations and resolutions of MJIA from a wide range of perspectives based on expertise and experience as experts in real estate appraisal, and to exert a check-and-balance function against the decisions of MJIA.

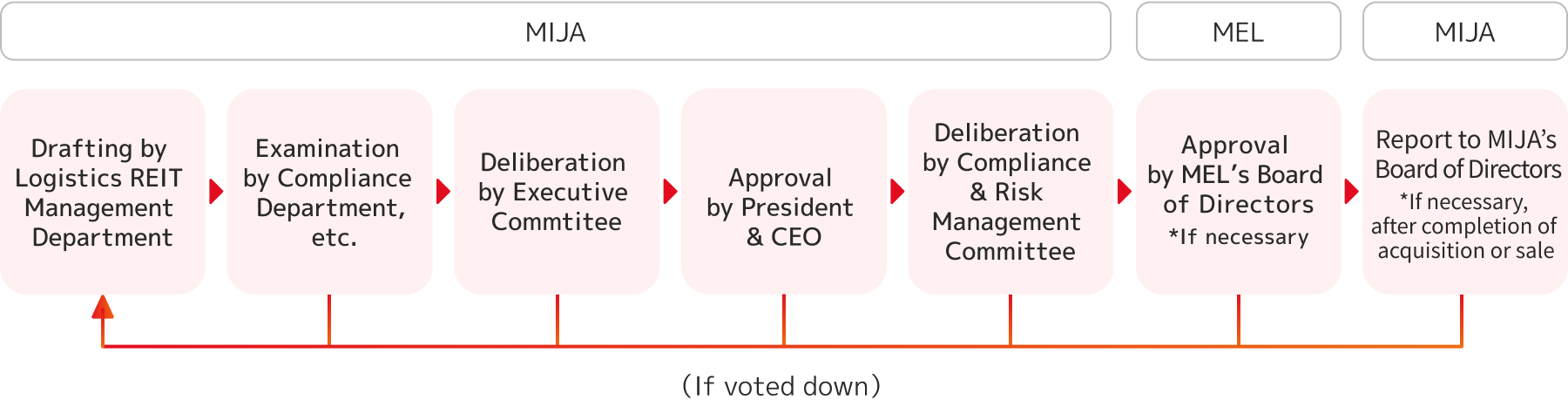

Decision-Making Flow in the Case of Asset Acquisition or Sale Falling Under Related-Party Transactions

Acquisition or sale of assets at MEL undergoes a transparent decision-making process.

(Note)An example of the decision-making flow in cases that fall under the category of transactions with interested persons, etc. requiring approval of the board of directors of the investment corporation pursuant to Article 201-2 of the Act on Investment Trusts and Investment Corporations.

MJIA Organizational Structure

The organizational structure of MJIA is as follows:

Asset Management Structure

Asset management fee structure aligned with the unitholders' interests

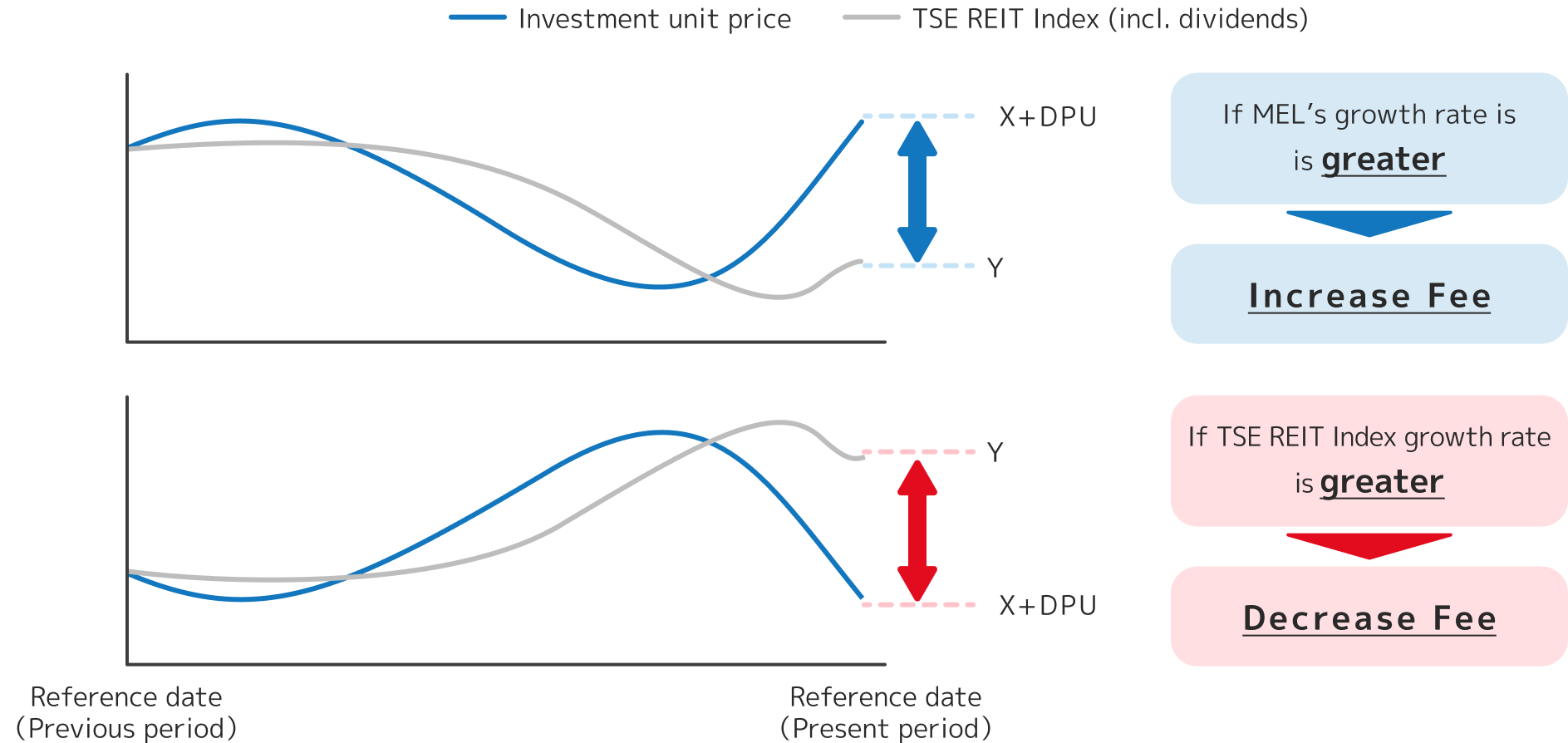

To strengthen the alignment between Asset Management Company and unitholder interest, MEL introduced an asset management fee reflecting the relative performance between MEL's investment unit price and the TSE REIT Index.

| Asset management fee Ⅰ (AUM-linked) |

Total assets as of the end of previous period x 0.2% (upper limit) |

|---|---|

| Asset management fee Ⅱ (Real estate profit-linked) |

Adjusted NOI × 5.0% (upper limit) |

| Asset management fee Ⅲ (Unitholder interest-linked) |

Adjusted net income before tax × net income before tax per unit × 0.001% (upper limit) |

| Asset management fee Ⅲ (Unitholder interest-linked) |

Performance against TSE REIT Index ((a) – (b)) × market capitalization (for fiscal period of each term) × 0.1% (upper limit)

(a):Fluctuations in MEL's investment unit price (incl. dividends) (b):Fluctuations in the TSE REIT Index (incl. dividends) |

| Acquisition fee | Acquisition price × 1.0% (upper limit) |

| Disposition fee | Disposition price × 0.5% (upper limit) |

| Merger fee | Appraisal value of assets to be succeeded × 1.0% (upper limit) |

First J-REIT to Introduce Asset Management Fee Fully Linked to Investment Unit Performance

Same-boat Investment by Mitsubishi Estate

Mitsubishi Estate, our sponsor holds our investment units with the aim of aligning the interests between unitholders and the sponsor.

Cumulative Investment System

In March 2021, MEC and MJIA introduced an investment unit cumulative investment plan for all full-time employees.