Environmental Initiatives (E) Green Finance

Sustainability-Linked Finance Framework

As an initiative to procure funds utilizing ESG assessments, MEL has been procuring funds through Sustainability Linked Loans ("SLL"). Based on the SLL agreement, MEL will be evaluated in every assessment period based on KPI and SPTs (Sustainability Performance Targets) including the targets below that MEL stipulates toward FY 2030, and also will be granted lower loan spread as an incentive according to the achievement status. For SPTs related to each loan, please refer to the "Remarks" of the Sustainability-Linked Loan.

❙ The selection of KPI

- KPI 1 : Total GHG Emissions(Scope 1+2)

- KPI 2 : Environmental Certification

- KPI 3 : GRESB Real Estate Assessment

❙ Measurement of SPT

- SPT 1 : FY2021 GHG emissions(Scope 1+2)42% reduction from actual 939.2t-CO2 by FY2030SBTi

- SPT 2 : All properties with Environmental Certification by FY2030

- SPT 3 : 4 stars or more GRESB Real Estate Rating continuously from the loan execution date

Environmental Certifications

Environmental Assessment and Certifications

❙ Characteristics of the Loan

If the one or more of SPTs is achieved on the specified Determination Date, the interest rate spread for the Interest Calculation Period falling after the respective Determination Date shall be reduced, and if any SPT is not achieved, the interest rate spread for the same period shall be either deferred or increased.

The specific range of interest rate linkage shall be separately stipulated in the loan agreement, etc. for each individual loan execution.

❙ Reporting and Verification

The framework stipulates that the following items are to be disclosed once a year (at the end of July each year) on MEL's website with regard to KPI-related results, etc.

This table can be scrolled sideways.

| No. | Reporting Content | Reporting Period |

|---|---|---|

| ① | Actual values for the reporting period of the KPI | Starting with the first year following the execution of the Sustainability-Linked Loan, and continuing annually until the final determination date. |

| ② | Status of achievement of SPTs in the reporting period. | |

| ③ | Information on the borrower's latest sustainability strategy as it relates to KPIs/SPTs |

Sustainability-Linked Loan

This table can be scrolled sideways.

| Lender | Borrowing Amount |

Procurement Date | Repayment Date | Remarks |

|---|---|---|---|---|

| The Norinchukin Bank | 2,000 million yen | Mar. 1, 2022 | Mar. 1, 2032 |

Third-Party Opinion from Japan Credit Rating Agency, Ltd. (JCR) (available only in Japanese) Conclusion of Sustainability Linked Loan Agreement Notice Concerning Debt Financing (including “Green Loan” and “Sustainability-Linked Loan”) |

| The Norinchukin Bank | 2,000 million yen | Oct. 25, 2022 | Oct. 25, 2031 |

Conclusion of Sustainability Linked Loan Agreement |

| SBI Shinsei Bank | 2,000 million yen | Dec. 1, 2022 | Dec. 1, 2031 | |

| Sumitomo Mitsui Banking Corporation | 3,000 million yen | Sep. 4, 2023 | Sep. 4, 2031 |

Notice Concerning Debt Financing (“Sustainability-Linked Loan”) |

| The Norinchukin Bank | 500 million yen | Sep. 29, 2023 | Sep. 29, 2031 | |

| Nippon Life Insurance Company | 1,000 million yen | Sep. 29, 2023 | Sep. 29, 2033 | |

| Sumitomo Mitsui Banking Corporation | 1,150 million yen | Sep. 2, 2024 | Sep. 2, 2032 |

Notice Concerning Debt Financing (“Sustainability-Linked Loan”) |

| Sumitomo Mitsui Banking Corporation | 1,350 million yen | Mar. 10, 2025 | Mar. 10, 2034 |

Notice Concerning Debt Financing (“Sustainability-Linked Loan”) |

| The Norinchukin Bank | 800 million yen | Sep. 1, 2025 | Sep. 1, 2032 |

Notice Concerning Debt Financing (including “Green Loan” and “Sustainability-Linked Loan”) |

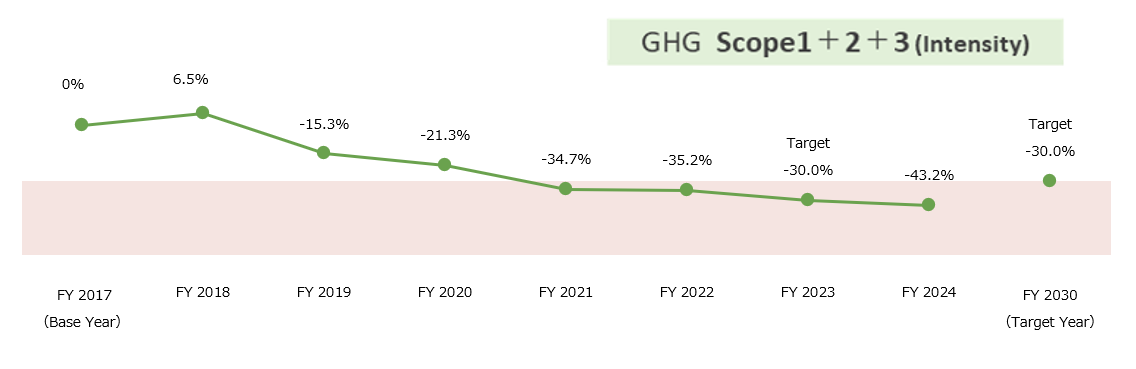

(Reference) Progress of old SPT①

Old SPT①:30% reduction by FY2030 (FY2017 standard)

This graph can be scrolled sideways.

This table can be scrolled sideways.

30% reduction by FY2030 (FY2017 standard)

| GHG emissions | GHG emissions (t-CO2) |

Breakdown (t-CO2) | Data coverage (Floor area basis) |

GHG emission intensity (t-CO2/m2) |

Percentage Change (intensity) |

||

|---|---|---|---|---|---|---|---|

| Scope1 | Scope2 (Location-based method) |

Scope3 (Category#13) |

|||||

| FY2017 | 13,754 | 0.0 | 9,319.7 | 4,434.3 | 100% | 0.025 | - |

| FY2018 | 14,662 | 0.0 | 9,608.0 | 5,053.8 | 100% | 0.026 | 6.5 |

| FY2019 | 14,885 | 0.1 | 5,763.3 | 9,121.3 | 100% | 0.021 | ▲ 15.3 |

| FY2020 | 16,755 | 0.3 | 6,811.4 | 9,943.6 | 100% | 0.019 | ▲ 21.3 |

| FY2021 | 17,598 | 0.4 | 7,011.0 | 10,586.9 | 100% | 0.016 | ▲ 34.7 |

| FY2022 | 22,219 | 0.3 | 2,849.0 | 19,369.5 | 100% | 0.016 | ▲ 35.2 |

| FY2023 | 22,514 | 0.6 | 2,811.9 | 19,701.9 | 100% | 0.015 | ▲ 40.4 |

| FY2024 | 21,871 | 0.5 | 2,755.4 | 19,114.6 | 100% | 0.014 | ▲ 43.2 |

| (Note) | We are only accounting for Scope 2 emissions for which MEL has management authority from FY2022. |

|---|

Green Finance Framework

Use of Proceeds of Green Finance

Net proceeds from the green bonds or green loans will be used to fund the acquisition of specified assets that will meet the eligibility criteria in below (Green Eligible Assets) or refinance borrowings required for acquiring the Green Eligible Assets.

Eligible Criteria

Eligible Criteria are assets or projects that satisfy either of the following requirements.

Properties that have obtained or renewed, or to obtain or renew in the future, any of the following certifications ① through ⑤

- ①DBJ Green building certification : 5-star, 4-star or 3-star

- ②CASBEE certification: CASBEE-Building CASBEE-Real estate (B+rank, A rank or S rank) / Municipal version of CASBEE (B+rank, A rank or S rank) (Note 1)

-

③BELS evaluation in FY2016 standard : 3-star, 4-star or

5-star (Note2)

BELS evaluation in FY2024 standard : level 4, level 5 or level 6 (Note3) - (Note 1)The look-back period shall be 3 years from the date of completion of construction.

- (Note 2)In the case of new acquisition for existing buildings built before 2016, existing non-compliant buildings (factories, etc. (including logistics facilities): BEI = 0.75 or more) are not permitted.

- (Note 3)New acquisitions of existing buildings built before 2016 must be Level 3 or above and excluding buildings with outdated legality (factories, etc. (including logistics facilities) : BEI=above 0.75).

- ④Renewable energy generation facilities associated with buildings (limited to solar power generation facilities on the premises)

- ⑤Equipment designed to reduce environmental impacts (limited to equipment that achieves 30% or higher energy efficiency before introduction)

Management of Proceeds

If there are unappropriated funds at the time of issuing green bonds or green loans, MEL will disclose an appropriation plan on its website. In addition, if the property for which the proceeds will be used will no longer be a subject of the use of proceeds due to its sale, MEL will disclose this in its press release and its website.

Upper limit of green finance procurement is calculated by total acquisition price of Eligible Green Projects multiple by total asset LTV.

(1)Green Building

- Number and Type of environmental certifications of the assets

- Water supply usage

- Total energy consumption (Electricity consumption and Gas fuel consumption)

- GHG emissions (Scope1、Scope2、Scope3)

- Waste management

(2)Renewable energy generation facilities associated with buildings (limited to solar power generation facilities on the premises)

- Annual power generation of solar panels

(3)Equipment designed to reduce environmental impacts (limited to equipment that achieves 30% or higher energy efficiency before introduction)

- Details of equipment introduced as equipment aimed at reducing environmental load and energy saving effect

Environmental Policy and Goals Data

Amount of Procured Funds and Allocation (As of August 31, 2025)

Total Acquisition Price

Eligible Criteria

LTV

LTV-based Green Finance (Debt) Capacity

| (Note 1) | The LTV-based Green Finance (Debt) Capacity =Total Acquisition Price of Green Eligible Assets × The Total Asset LTV |

|---|---|

This table can be scrolled sideways.

| Number of Properties | Amount | |

|---|---|---|

| Total Properties | 37 | 280,623 million yen |

| Eligible Criteria (Note) | 28 | 252,700 million yen |

| CASBEE | 22 | 224,021 million yen |

| BELS | 26 | 243,797 million yen |

| (Note) | When one property has obtained multiple environmental certifications and evaluations, it is counted as one property. |

|---|

This table can be scrolled sideways.

| Funds | Procurement Date |

Repayment Date/ Redemption Date |

Allocation | Use of Initial Funds | ||

|---|---|---|---|---|---|---|

| Green Loan (Mizuho Bank) |

720 million yen | Sep. 14, 2021 | Sep. 14, 2028 | allocated | Aquisition of Logicross Fukuoka Hisayama, LOGIPORT Sagamihara (49% co-ownership interest), LOGIPORT Hashimoto (45% co-ownership interest), MJ Logipark Kazo 1 |

|

| Green Bond | 2,000 million yen | Apr. 14, 2021 | Apr. 14, 2036 | allocated | Acquisition of LOGIPORT Osaka Taisho(20% co-ownership interest), Logicross Osaka(additional acquisition of 40%), Logicross Nagoya Kasadera(additional acquisition of 40%) |

|

| Green Loan (Mizuho Bank) |

1,000 million yen | Mar. 1, 2022 | Mar. 1, 2031 | allocated | Acquisition of Logicross Atsugi Ⅱ, LOGIPORT Kawasaki Bay (45% co-ownereship interest) |

|

| Green Loan (Shinkin Central Bank) |

2,000 million yen | Mar. 1, 2022 | Mar. 1, 2032 | allocated | ||

| Green Loan (SBI Shinsei Bank) |

1,000 million yen | Mar. 1, 2022 | Mar. 1, 2032 | allocated | ||

| Green Loan (The Yamaguchi Bank) |

1,000 million yen | Mar. 1, 2022 | Mar. 1, 2032 | allocated | ||

| Green Loan (Sumitomo Mitsui Banking Corporation) |

1,000 million yen | Oct. 25, 2022 | Oct. 31, 2026 | allocated | Acquisition of LOGiSTA・Logicross Ibaraki Saito (A) (45% co-ownership interest), LOGiSTA・Logicross Ibaraki Saito (B) (45% co-ownership interest), |

|

| Green Loan (Daishi Hokuetsu Bank) |

1,000 million yen | Oct. 25, 2022 | Oct. 31, 2027 | allocated | ||

| Green Loan (The Chiba Bank) |

2,000 million yen | Oct. 25, 2022 | Oct. 31, 2027 | allocated | ||

| Green Loan (Mizuho Bank) |

1,000 million yen | Oct. 25, 2022 | Oct. 31, 2031 | allocated | ||

| Green Loan (Sumitomo Mitsui Banking Corporation) |

2,880 million yen | Dec. 14, 2022 | Oct. 25, 2026 | allocated | Acquisition of Logicross Fukuoka Hisayama, LOGIPORT Sagamihara (49% co-ownership interest), LOGIPORT Hashimoto (45% co-ownership interest), MJ Logipark Fukuoka 1, MJ Logipark Kazo 1, Logicross Atsugi Logicross Kobe Sanda |

|

| Green Loan (The Yamaguchi Bank, Ltd.) |

1,500 million yen | Mar. 14, 2023 | Sep. 1, 2032 | allocated | Acquisition of Logicross Yokohama Kohoku, LOGiSTA・Logicross Ibaraki Saito (A) (45% co-ownership interest), LOGiSTA・Logicross Ibaraki Saito (B) (45% co-ownership interest), MJ Logipark Inzai 1, MJ Logipark Takatsuki 1 |

|

| Green Bond | 2,500 million yen | Jul. 25, 2023 | Jul. 25, 2033 | allocated | Acquisition of Logicross Fukuoka Hisayama, LOGIPORT Sagamihara (49% co-ownership interest), LOGIPORT Hashimoto (45% co-ownership interest), MJ Logipark Kazo 1, MJ Logipark Fukuoka 1, LOGIPORT Kawasaki Bay (45% co-ownereship interest), Logicross Atsugi Ⅱ |

|

| Green Loan (Mizuho Bank) |

1,330 million yen | Sep. 14, 2023 | Sep. 14, 2030 | allocated | Acquisition of Logicross Fukuoka Hisayama, LOGIPORT Sagamihara (49% co-ownership interest), LOGIPORT Hashimoto (45% co-ownership interest), MJ Logipark Kazo 1, MJ Logipark Osaka 1, MJ Logipark Fukuoka 1 |

|

| Green Loan (The Gunma Bank) |

300 million yen | Sep. 29, 2023 | Sep. 29, 2028 | allocated | Acquisition of MJ Logipark Kakogawa 1 | |

| Green Loan (Daishi Hokuetsu Bank) |

300 million yen | Sep. 29, 2023 | Sep. 29, 2028 | allocated | ||

| Green Loan (Shinkin Central Bank) |

500 million yen | Sep. 29, 2023 | Sep. 29, 2032 | allocated | ||

| Green Loan (Daishi Hokuetsu Bank) |

1,500 million yen | Mar. 31, 2025 | Mar. 31, 2029 | allocated | Acquisition of MJ Logipark Kakogawa 1 | |

| Green Loan (SBI Shinsei Bank) |

300 million yen | Sep. 1, 2025 | Sep. 1, 2028 | allocated | Acquisition of LOGIPORT Osaka Taisho (Additional acquisition of 17.5%), Logicross Osaka (Initial acquisition of 60%), Logicross Nagoya Kasadera (Initial acquisition of 60%) |

|

| Green Loan (Bank of Iwate) |

1,500 million yen | Sep. 1, 2025 | Sep. 1, 2031 | allocated | ||

| Green Loan (Mitsubishi UFJ Trust and Banking Corporation) |

2,820 million yen | Sep. 16, 2025 | Sep. 16, 2036 | allocated | Acquisition of LOGIPORT Osaka Taisho(Initial acquisition of 20%), MJ Logipark Kasugai 1, MJ Logipark Nishinomiya 1, Logicross Fukuoka Hisayama, LOGIPORT Sagamihara, LOGIPORT Hashimoto, MJ Logipark Fukuoka 1, MJ Logipark Osaka 1, MJ Logipark Kazo 1 Logicross Osaka Katano |

|

| Green Loan (The Norinchukin Bank) |

800 million yen | Sep. 16, 2025 | Sep. 16, 2031 | allocated | Acquisition of Logicross Kobe Sanda, Logicross Atsugi |

|

| Green Loan (SBI Shinsei Bank) |

2,700 million yen | Sep. 22, 2025 | Sep. 22, 2028 | allocated | Acquisition of Logicross Osaka Katano | |

| Green Loan (The Keiyo Bank) |

1,000 million yen | Sep. 22, 2025 | Sep. 30, 2030 | allocated | ||

| Green Loan (Shinkin Central Bank) |

375 million yen | Oct. 9, 2025 | Oct. 9, 2031 | allocated | Acquisition of LOGIPORT Osaka Taisho(Initial acquisition of 20%), MJ Logipark Kasugai 1, MJ Logipark Nishinomiya 1 |

|

| Green Loan (Shinkin Central Bank) |

375 million yen | Oct. 9, 2032 | allocated | |||

| Green Loan (Resona Bank) |

2,000 million yen | Oct. 27, 2025 | Oct. 27, 2030 | allocated | Acquisition of Logicross Yokohama Kohoku, LOGiSTA・Logicross Ibaraki Saito (A) (45% co-ownership interest), LOGiSTA・Logicross Ibaraki Saito (B) (45% co-ownership interest), MJ Logipark Inzai 1, MJ Logipark Takatsuki 1, MJ Logipark Higashi Osaka 1 |

|

| Total Green Finace (Debt) | 35,400 million yen | |||||

| LTV-based Green Finance (Debt) Capacity | 107,903 million yen | |||||

Evaluation by Third-Party Entities

MEL has obtained a Green 1(F) (highest for JCR Green Bond Evaluation) rating in preliminary evaluation for the competence of its Green Finance Framework from Japan Credit Rating Agency, Ltd. (JCR). Please refer to JCR’s website.

Green Equity Framework

Use of Proceeds of Green Equity

Net proceeds from Green Equity Offering will be used to fund the acquisition of specified assets that will meet the eligibility criteria in below (Green Eligible Assets) or refinance borrowings required for acquiring the Green Eligible Assets.

Eligibility Criteria

Eligible Criteria are assets or projects that satisfy one of the following requirements.

-

a.Properties that obtained or renewed, or to be acquired in the future with one of the certifications from a third-party certifier listed in (1) to (3) below.

- (1) DBJ Green building certification: 5, 4 or 3 stars

- (2) CASBEE Certification: S, A or B+

- (3) BELS Evaluation: 5, 4 or 3 stars

-

b.Renewable energy generation facilities associated with buildings

(limited to solar power generation facilities on the premises) -

c.Equipment designed to reduce environmental impacts

(limited to equipment that achieves 30% or higher energy efficiency before introduction)

Management of Proceeds

Net proceeds from the Green Equity Offering will be used to the acquisition of new or existing properties or to refinance immediately after the execution of that. The proceeds from the Green Equity Offering are managed in cash or cash equivalents until the fully allocated to the eligible green projects.

Reporting

MEL will disclose the allocation plans with respect to the appropriation of proceeds from the Green Equity Offering, if any, that is not yet allocated at the time of issuance of the investment units. In addition, regarding the status of allocation of proceeds and the following impact reporting, the amount to be appropriated and the detail of subjected property to be appropriated shall be disclosed promptly. Disclosure of the allocation status shall be completed upon the allocation of the proceeds are completed.

<Status of Green Building>

-

Number, Type, and Rank of environmental certifications of the assets

- For detailed information : Environmental Certifications

<Environmental Benefit>

*Disclose on a portfolio basis considering confidential information of MEL.

Water usage

-

Total energy consumption (electricity consumption and gas/fuel consumption)

GHG emissions

Waste discharge weight

Solar power electricity generation

-

Details of equipment and facilities installed to reduce environmental impacts and energy efficiency(saving) benefits.

- For detailed information : Environmental Performance Data

Amount of Procured Funds and Allocation

This table can be scrolled sideways.

| Funds | Payment Date |

Date of Allocation |

Allocation | Use of Initial Funds | |

|---|---|---|---|---|---|

| 5th Follow-on Offering | 22,042 million yen | Mar. 1, 2022 | Mar. 1, 2022 | allocated |

Acquisition of Logicross Atsugi Ⅱ and LOGIPORT Kawasaki Bay (45% co-ownereship interest) |

Evaluation by Third-Party Entities

MEL formulated “Green Equity Framework” with reference to the four elements indicated by the Green Bond Principles stipulated by the International Capital Market Association (ICMA) and the Green Bond Guidelines by the Ministry of the Environment. MEL has obtained a second-party opinion for the eligibility of the “Green Equity Framework” from DNV GL, a third-party ESG evaluation agency.

<Disclaimer>

Our Green Equity Framework and DNV’s second opinion related thereto are available here, consistent with our past disclosure practice with respect to our financings. These documents do not constitute an offer or sale of our securities in Japan, the United States or any other jurisdiction. Neither we nor Mitsubishi Jisho Investment Advisors, Inc., our asset manager, are experts in green equity assessment, nor do we have the ability to assess or independently verify the assessment provided to us by DNV. The information contained in the Green Equity Framework or DNV’s second opinion should not be relied upon in making an investment decision with respect to any of our securities.