Environmental Initiatives (E) Environmental Policy and Goals

Basic Policy

MJIA has established an environmental management system and strives to protect the environment by promoting environmental initiatives and reducing environmental impact, while also complying with environmental laws and regulations. The Mitsubishi Estate Group also proposes cutting-edge environmental initiatives to ensure that its business activities play a leading role in the development of sustainable communities.

MEL strives to invest in environmentally friendly logistics facilities, and will continue to focus on maximizing the energy efficiency of our properties and is committed to minimizing environmental impact through various sustainable features and initiatives.

KPI Trends

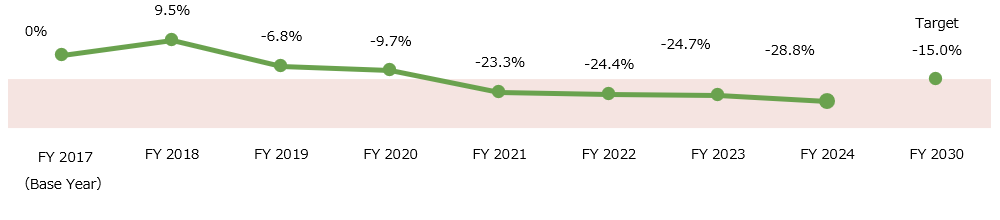

1. Energy

Reduce energy consumption intensity by 15% by FY2030 (Based on FY2017)

This graph can be scrolled sideways.

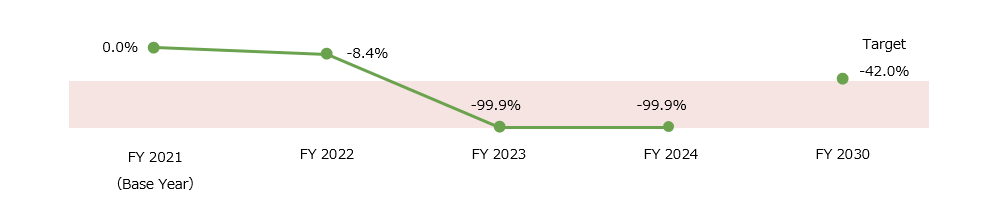

2. GHG

Achieve net zero GHG emissions (including the entire value chain) by FY2050SBTi

42% reduction in total GHG emissions by FY2030 (Scope 1 + 2) (based on FY2021)SBTi

This graph can be scrolled sideways.

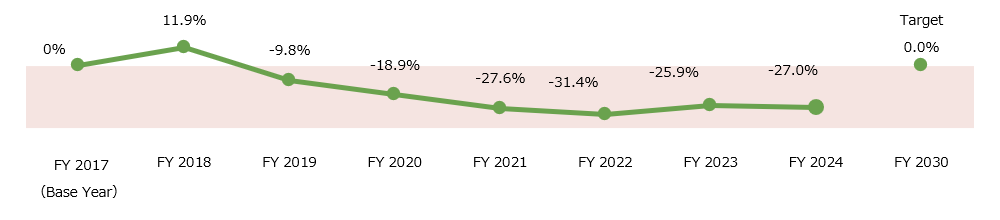

3. Water Consumption

No increase in water consumption until FY2030 (based on FY2017)

This graph can be scrolled sideways.

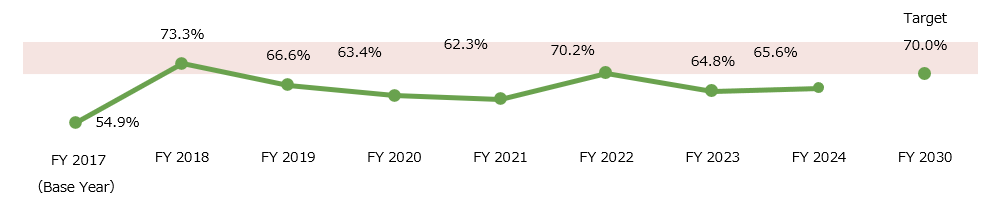

4. Waste Management

Recycling rate of 70% or more by FY2030.

This graph can be scrolled sideways.

5. Environmental Certification

Increasing Environmental Certification to 100% by FY 2030

For environmental certifications, please see below.

https://mel-reit.co.jp/ja/esg/external/greenbuilding.html

Environmental Performance Data

This table can be scrolled sideways.

15% reduction by FY2030 (FY2017 standard)

| Energy Consumption | Total energy consumption (MWh) |

Breakdown (MWh) | Data coverage (GFA basis) (Note 1) |

Energy consumption intensity (kWh/m2) (Note 2) |

Percentage Change (intensity) |

|

|---|---|---|---|---|---|---|

| Gas/fuel consumption |

Electricity consumption |

|||||

| FY2017 | 27,920 | 1,625 | 26,294 | 100% | 50.20 | - |

| FY2018 | 30,601 | 1,629 | 28,972 | 100% | 54.95 | 9.5% |

| FY2019 | 33,314 | 1,793 | 31,521 | 100% | 46.78 | ▲6.8% |

| FY2020 | 39,146 | 2,504 | 36,642 | 100% | 45.30 | ▲9.7% |

| FY2021 | 42,172 | 2,613 | 39,559 | 100% | 38.49 | ▲23.3% |

| FY2022 | 52,716 | 2,790 | 49,926 | 100% | 37.95 | ▲24.4% |

| FY2023 | 57,791 | 3,097 | 54,694 | 100% | 37.81 | ▲24.7% |

| FY2024 | 55,156 | 2,947 | 52,209 | 100% | 35.63 | ▲28.8% |

42% reduction of GHG emissions(Scope 1 + 2)by FY2030 (FY2021 standard)SBTi

achieve net zero GHG emissions for the entire value chain by FY2050SBTi

This table can be scrolled sideways.

(unit: t-CO2)

| GHG | Scope1 | Scope2(Note1) (Market-based method) |

Scope1+2 | Percentage Change | Scope3(Note2) | Scope1+2+3 | Data coverage (Floor area basis) |

||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| category1 | category2 | category3 | category5 | category13 | |||||||

| FY2021 | 0 | 939 | 939 | - | 2,541 | 1,025 | 734 | 390 | 8,558 | 14,187 | 100% |

| FY2022 | 0 | 860 | 860 | ▲8.4% | 3,060 | 890 | 229 | 398 | 13,340 | 18,777 | 100% |

| FY2023 | 1 | 0 | 1 | ▲99.9% | 3,639 | 2,301 | 164 | 633 | 13,895 | 20,633 | 100% |

| FY2024 | 0 | 0 | 0 | ▲99.9% | 3,926 | 1,063 | 231 | 544 | 13,712 | 19,476 | 100% |

(Note1)Scope 2 (Market-based method) is calculated considering co-ownership. MEL purchased non-fossil fuel certificates equivalent to our entire Scope 2 emissions from FY2023, achieving a 100% offset of our Scope 2 emissions.

(Note2)Starting in fiscal year 2023, we will begin tallying data by category.Please check Green Finance for aggregated data for previous years.

This table can be scrolled sideways.

Do not increase by FY2030 (FY2017 standard)

| Water Consumption | Water supply usage (m3) | Data coverage (GFA basis)(Note 1) |

Water consumption intensity (m3/m2) (Note 2) |

Percentage Change |

|---|---|---|---|---|

| FY2017 | 63,255 | 100% | 0.114 | - |

| FY2018 | 70,833 | 100% | 0.127 | 11.9% |

| FY2019 | 73,839 | 100% | 0.103 | ▲9.8% |

| FY2020 | 80,550 | 100% | 0.092 | ▲18.9% |

| FY2021 | 84,855 | 100% | 0.082 | ▲27.6% |

| FY2022 | 110,410 | 100% | 0.078 | ▲31.4% |

| FY2023 | 128,747 | 100% | 0.084 | ▲25.9% |

| FY2024 | 128,306 | 100% | 0.083 | ▲27.0% |

This table can be scrolled sideways.

70% or more by FY2030

| Waste Management | Waste discharge weight (t) | Data coverage (Floor area basis) (Note 1) |

Data coverage (GFA basis) (Note 1) |

|---|---|---|---|

| FY2017 | 1,202 | 82.5% | 54.9% |

| FY2018 | 1,624 | 87.9% | 73.3% |

| FY2019 | 1,700 | 93.6% | 66.6% |

| FY2020 | 1,867 | 86.7% | 63.4% |

| FY2021 | 3,939 | 90.6% | 62.3% |

| FY2022 | 4,802 | 79.1% | 70.2% |

| FY2023 | 4,849 | 86.4% | 64.8% |

| FY2024 | 4,540 | 90.0% | 65.6% |

(Note 1)Numerator: Total floor area (m2) of properties for which data for the current year are identified. Denominator: Total portfolio floor area for the current fiscal year

(Note 2)The basic unit is a value calculated by considering the utilization rate, with the numerator for each consumption, etc., and the total portfolio floor area for each fiscal year as the denominator.

(Note 3)Emissions from the tenant-management portion are accounted for in Scope3 based on the owners/tenants' control authority.

In addition, Scope of the same property may differ from year to year depending on the status of acquiring the data.

This table can be scrolled sideways.

| Solar Power Generation | Annual power generation (Kwh) (Note) |

|---|---|

| FY2018 | 7,017,147 |

| FY2019 | 6,710,582 |

| FY2020 | 11,432,928 |

| FY2021 | 14,311,834 |

| FY2022 | 14,709,934 |

| FY2023 | 18,124,693 |

| FY2024 | 19,465,251 |

(Note)Renewable energy generated by the portfolio properties is sold externally with some exceptions. The figures for co-ownership properties are based on 100%. The amount of solar power generation is based on the properties for which the requisite data and periods are available.

Some data that is the basis of the above table "Environment-related data" is subject to limited guarantee by a third-party organization (Japan Environmental Certification Organization). Please refer to the following third party warranty report for details.

※Greenhouse Gas Emissions Independent Verification Report

※Environmental Performance Data Independent Verification Report